Press Statement by DAP Secretary-General and MP for Bagan, Lim Guan Eng in Kuala Lumpur on 2.8.2020.

The Malaysian Government Must Justify That It Was Not Duped By Goldman Sachs, Widely Credited As Securing A Good Deal For The USD2.5 Billion Cash Settlement, Instead Of USD 7.5 Billion, To Defraud 1MDB Together With Malaysian Leaders And Their Cronies.

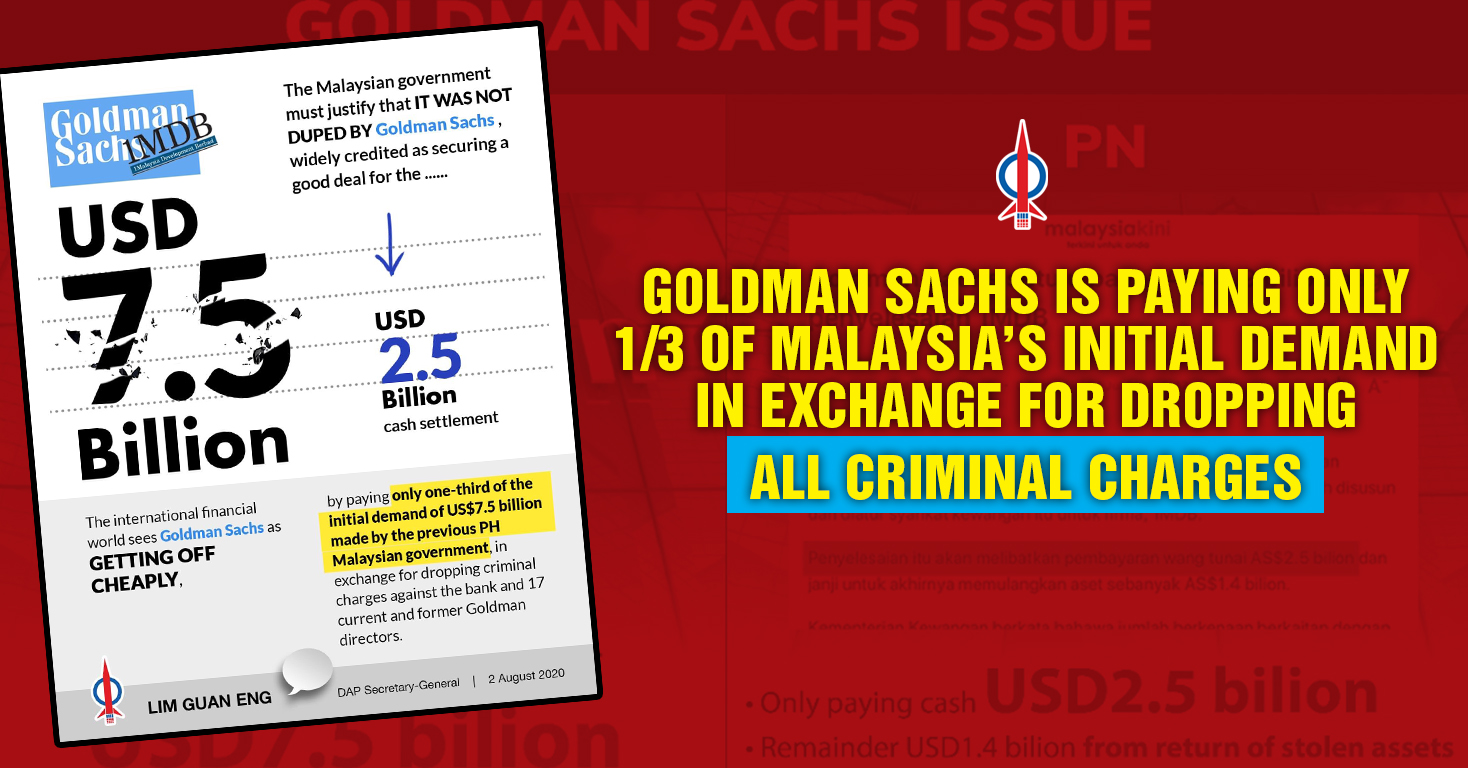

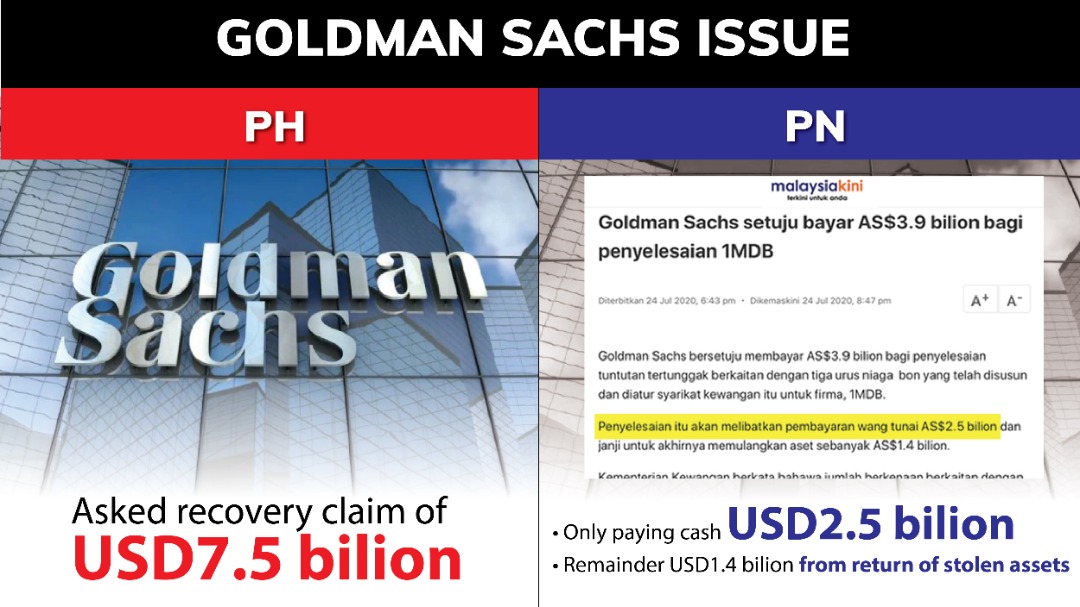

The Malaysian government must justify that it was not duped by Goldman Sachs, widely credited as securing a good deal for the USD2.5 billion cash settlement, instead of USD 7.5 billion, to defraud 1MDB together with Malaysian leaders and their cronies. The international financial world sees Goldman as getting off cheaply by paying only one-third of the initial demand of US$7.5 billion made by the previous PH Malaysian government, in exchange for dropping criminal charges against the bank and 17 current and former Goldman directors.

Prime Minister Tan Sri Muhyddin Yassin announcement that global banking firm Goldman Sachs has agreed to a US$3.9 billion (RM16.63 billion) settlement with the Malaysian government on defrauding of 1MDB, cannot hide the fact that US$1.4 billion is not paid by Goldman Sachs but will come from assets of 1MDB seized by authorities around the world.

Former Prime Minister Datuk Seri Najib Tun Razak was sentenced on 28 July 2020 by the High Court to 12 years in jail and RM210 million in fines, after finding him guilty of all seven charges on money laundering, abuse of power and criminal breach of trust in the case involving RM42 million of funds deposited in his personal accounts from a former unit of troubled state fund 1MDB. Like Najib, if Goldman Sachs is found guilty, apart from imprisonment, they could be fined 5 times the amount defrauded.

The previous Pakatan Harapan (PH) Malaysian government had claimed USD7.5 billion to recover USD6.5 billion in the following three 10-year bonds arranged by Goldman Sachs guaranteed by the Malaysian government at an interest rate above the prevailing market rates of:

- USD1.75 billion at 5.99% interest rate issued on 18 May 2012

- USD1.75 billion at 5.75% interest rate issued on 17 Oct 2012

- USD3.0 billion at 4.4% interest rate issued on 16 Mar 2013

The previous PH government had claimed USD 7.5 billion from Goldman Sachs, to include the additional USD1 billion to cover interest cost incurred for the bonds to date.

To forgo the initial USD 7.5 billion claim with only USD 3.9 billion ignores the huge debt burden of 1MDB. The total 1MDB debt outstanding guaranteed by the Government is RM 31.7 billion ringgit. If the remaining interest payments till 2038 are included, the amount would increase to RM 41.5 billion. This sum excludes the RM8.9 billion which have already been paid by the Government. This would bring the total cost of 1MDB to the country, including interest of the 1MDB debts, to RM 50.4 billion.

The deal to drop all criminal charges against Goldman Sachs for only 1/3 of the initial demand of USD 7.5 billion, follows the decision in May 2020 to discharge Najib’s step-son Riza Shahriz Abdul Aziz, from five money-laundering charges over US$248 million (RM1.08 billion) of funds siphoned from 1Malaysia Development Bhd (1MDB), in exchange for Riza returning USD 108 million.

Former Attorney-General Tommy Thomas commented that,“Riza Aziz is not offering to pay any new monies from any source other than United States’ Department of Justice’s (DoJ) seized assets. The US$108 million would in any event be returned to Malaysia by DoJ.”

Public interest and accountability demands that the Perikatan Nasional government answer whether justice is served on Malaysians, by allowing Goldman Sachs to pay one third of the initial demand of USD 7.5 billion in exchange for absolving Goldman Sachs of all criminal punishment, for their role as accomplices and complicity in the RM50.4 billion 1MDB scandal with top Malaysian leaders and their cronies?

LIM GUAN ENG,

DAP Secretary-General,

Member of Parliament for Bagan.