The government must do whatever it takes for our country to overcome the scathing recession brought forth by the Covid-19 pandemic. That’s why we need an additional RM45 billion economic stimulus injection as suggested by DAP Secretary-General and Bagan MP, Lim Guan Eng.

This is a necessary step in order for us to quickly come out of the Covid-19 economic recession. Here’s everything you need to know:

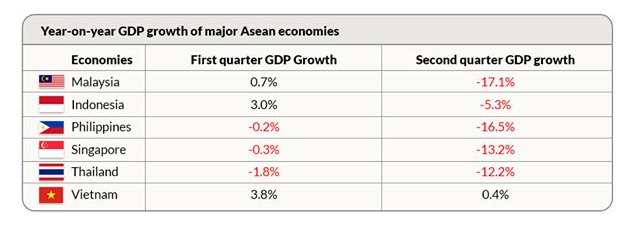

1. Malaysia’s GDP contraction is the worst in ASEAN

Look at the table above of the year-on-year GDP growth of major ASEAN economies and you’d see that Malaysia sits on top for all the wrong reasons.

Malaysia’s GDP contraction of 17.1% in the second quarter is the worst in ASEAN.

Furthermore, Thailand, a country which depends two times more heavily on tourism than us, just announced a smaller than expected GDP second quarter growth contraction of 12.2%.

This goes to show that if the Federal government continues to adopt a lackadaisical attitude that the economy will right itself, then we are in for a rude shock for the remainder of the year.

Although another RM45 billion fund injection may cause our fiscal deficit to widen to 9% of GDP, it will allow Malaysia to:

- Quickly come out of the Covid-19 economic recession.

- Save businesses and jobs.

2. A 9% GDP deficit is tolerable when people’s lives are on the line

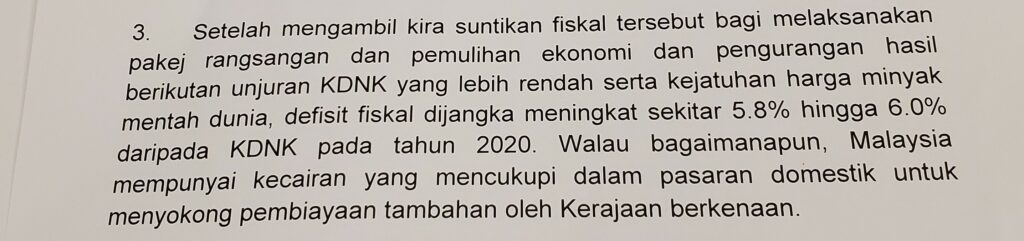

Based on the Finance Ministry’s figures of a 5.8% to 6% deficit to GDP for 2020 as seen below, an additional RM45 billion fund injection would cause the deficit to rise up to 9% of GDP.

However, a deficit of 9% of GDP would be tolerable, considering it would save people’s lives by rescuing their businesses and jobs. In fact, a 9% deficit would not be the worst numbers on record.

Malaysia’s worst deficit to GDP were in these years:

- 16.6% in 1982.

- 15.6% in 1981.

3. Even government MPs believe PN is not doing enough to mitigate recession

Economic data clearly shows that the government has not been doing enough to mitigate the recession. Despite a similar RM45 billion fund injection back in April, Bank Negara Malaysia’s data shows that:

- Government’s second quarter operating expenditure fell 2.1% from a year ago.

- For comparison, there was a 5.2% increase in the first quarter.

Despite the government’s attempt a political spin, even their own backbenchers don’t believe that the government is doing enough to mitigate recession.

4. A domestic debt issuance can be easily absorbed and digested

Furthermore, the government can rely on borrowings from the domestic market for the RM45 billion fund injection.

This is the exact way the government used for its initial RM45 billion fund injection in April. As of the end of June 2020, the local bond market size was RM1.6 trillion which includes:

- Government bond.

- Corporate bond.

- Bank Negara Malaysia papers.

Therefore, a domestic RM45 billion debt issuance would be easily absorbed and digested.

At the end of the day, people’s lives are on the line and another RM45 billion economic stimulus injection is exactly what we need to survive this Covid-19 economic recession.