Press Statement

9th December 2020

Fitch Ratings’ decision to downgrade both Petroliam Nasional Bhd’s (Petronas) and Telekom Malaysia Bhd’s international credit ratings demonstrate the adverse consequences of the earlier downgrade of Malaysia’s sovereign credit ratings to ‘BBB+’ from ‘A-‘. This is the price to be paid by Malaysian companies for Malaysia’s downgrade, together with the accompanying loss of investor confidence.

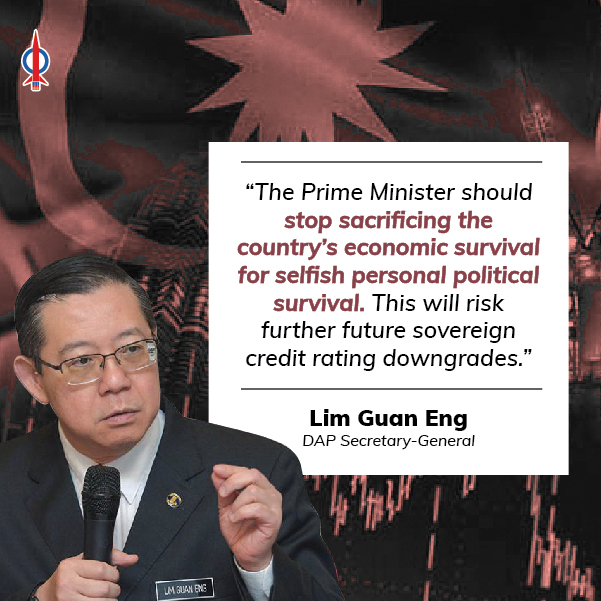

However, the people will pay an even higher price if Prime Minister Tan Sri Muhyiddin Yassin continues to dismiss the two principal concerns of Fitch, namely political instability, as well as poor governance standards and transparency. The Prime Minister should stop sacrificing national interests for selfish political survival by refusing to allow a motion of no-confidence in Parliament to disprove popular belief that he has lost his parliamentary majority.

Source: Nikkei Asia

The Prime Minister should also stop the practice of buying political support by offering political posts of directors and Chairman of Government-Linked Corporations (GLCs). What an irony that one of the posts offered was the Petronas Chairman to Gua Musang UMNO MP Tengku Razaleigh Hamzah, who rejected the post because Tengku deemed such an offer was unconstitutional.

Choosing personal political survival over economic survival of the country will risk further future sovereign credit rating downgrades. If the Prime Minister still refuses to heed Fitch’s twin concerns, then the Finance Ministry’s attempt to address the escalating government debt through fiscal consolidation next year will be doomed to fail.

The government’s total debt and liability exposures are estimated to be RM1.257 trillion or 87.3% of the gross domestic product (GDP), as at the end of September 2020. This is much higher than what was recorded during the PH government era. Federal debt as at September-end amounted to RM874.3 billion or 60.7% of GDP. However, the Finance Ministry has cleverly used statutory limit calculations on the federal debt to be set at 56.6% of the GDP, which is less than the 60% limit set recently.

This year’s deficit has increased to 6% of the GDP and fiscal consolidation measures next year will reduce the deficit to 5.4%. Instead of spending more by borrowing to encourage economic growth and save jobs, businesses and livelihoods, the Finance Ministry has chosen to spend less next year to safeguard our sovereign credit ratings. Clearly the fiscal consolidation measures for next year have not impressed Fitch. This has put the Malaysian economy in the “worst of both worlds” situation, not spending enough next year for the people, but still not convincing the independent ratings experts of the sterling quality of our country’s credit-worthiness.

Knowing fairly well that our sovereign credit ratings was beyond salvation because of his failure to address the twin principal concerns of political instability and poor governance, the Prime Minister should have spent and borrowed more to save jobs, businesses and livelihoods next year. He should set a course correction and spend an additional RM45 billion next year to protect economic growth, the same amount that he spent in this year’s stimulus package.

Lim Guan Eng

DAP Secretary-General

MP for Bagan