Press Statement by MP for Kepong, Lim Lip Eng in Kuala Lumpur on 6 January 2022:

Now, the Securities Commission Malaysia and the Attorney-General’s Office have to answer to the nation!

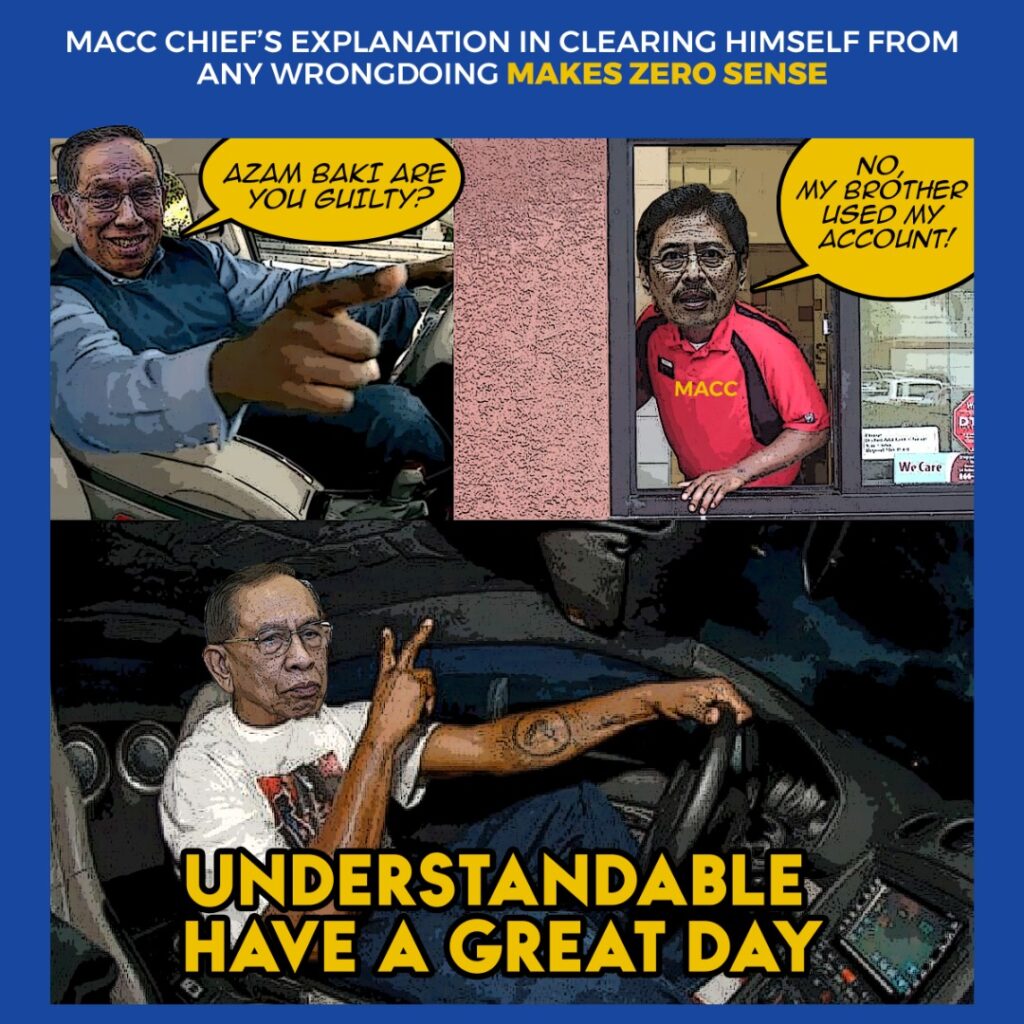

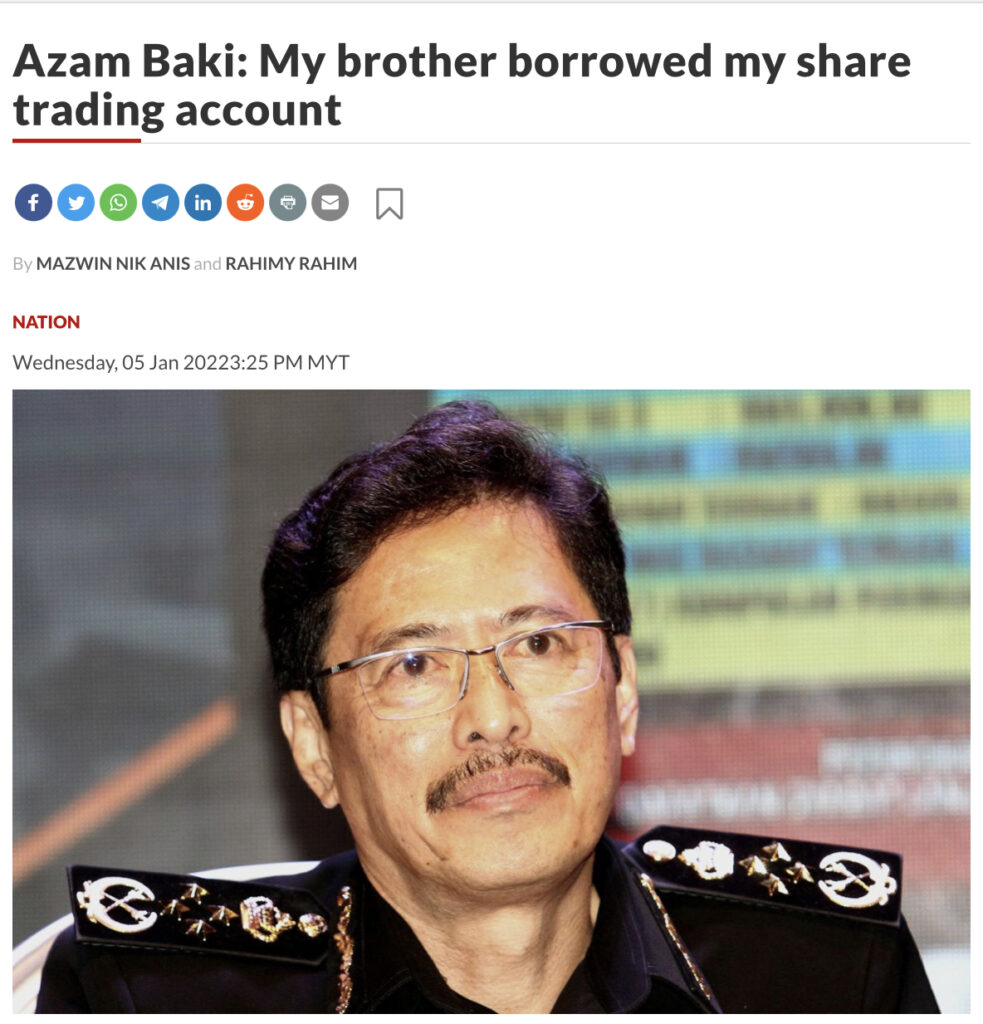

The explanation given by Anti-Corruption Advisory Board chairperson, Abu Zahar Ujang on the MACC chief, Azam Baki allowing his brother to use his trading account to acquire shares in two companies in 2015, has raised more questions.

The Securities Commission Malaysia has the duty to state if Azam Baki has breached any securities law. Also, has the Attorney-General carried out a full investigation into Azam Baki’s case and cleared him of any wrongdoings?

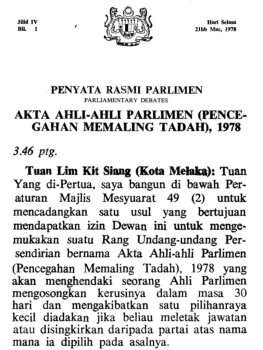

Section 25 (6) of Securities Industry (Central Depositories) Act 1991 (SICDA) provides that:

“Any person who contravenes subsection (1), (2) or (5) shall be guilty and shall, on conviction, be liable to a fine not exceeding three million ringgit or to imprisonment for a term not exceeding ten years or to both.”

Subsections (1), (2) and (5) of that section basically says that no trading of securities shall be carried out using the trading account of another person, unless he or she is an authorised depository agent who has opened and maintained a securities account with the central depository.

Section 25A of SICDA also states that an authorised nominee shall hold deposited securities for one beneficial owner in respect of each securities account. Section 25A (3) of the same act provides that any person who contravenes this act shall be guilty of an offence and shall, on conviction, be liable to a fine not exceeding three million ringgit or to imprisonment for a term not exceeding ten years or to both.

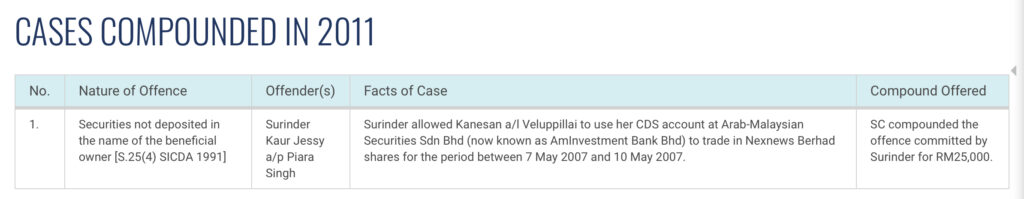

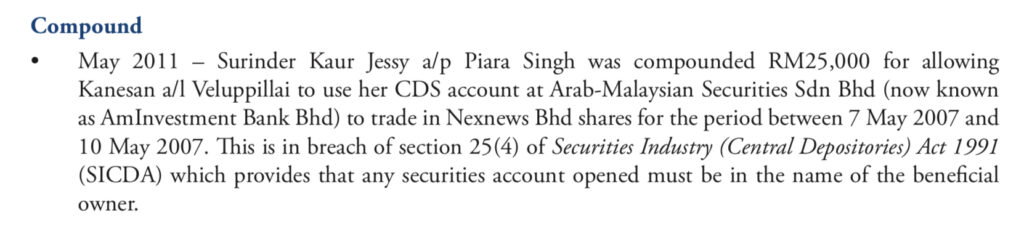

In May 2011, the Securities Commission Malaysia compounded a woman RM25,000 for allowing another person to use her central depository system account at Arab-Malaysian Securities Sdn Bhd (now known as AmInvestment Bank Bhd) to trade in Nexnews Bhd shares for the period between 7 May 2007 and 10 May 2007. This is in breach of section 25(4) of SICDA which provides that any securities account opened must be in the name of the beneficial owner.