Press Statement by DAP Secretary-General and MP For Bagan, Lim Guan Eng in Kuala Lumpur On 26 July 2020

The Prime Minister should assure the public that he has not sold Malaysians short or allowed Goldman Sachs to get off too lightly for their involvement in one of the largest financial scandals in history – the RM50.4 billion 1MDB scandal.

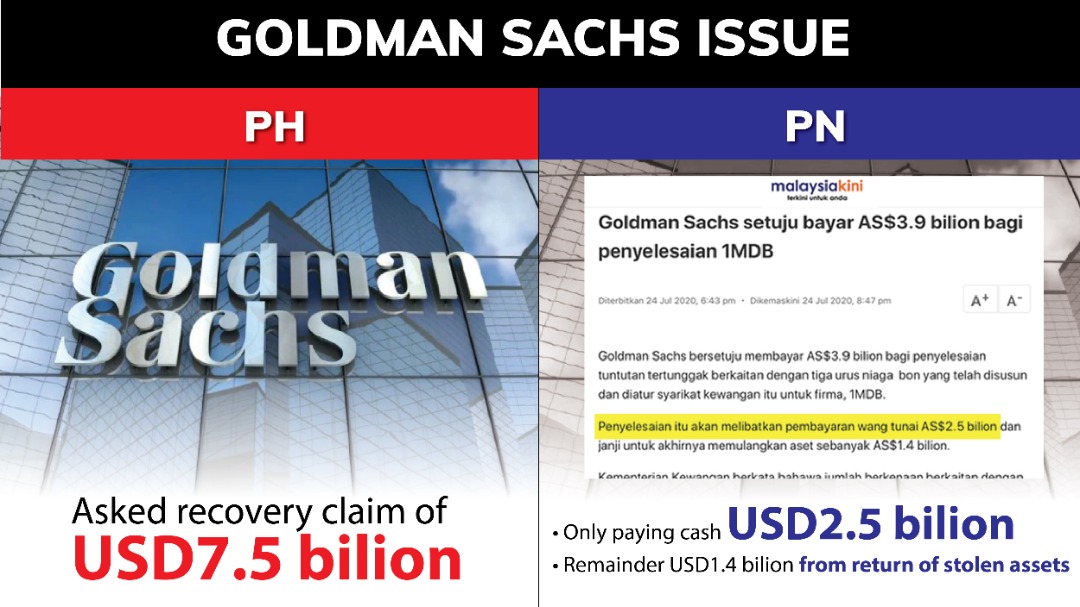

The announcement by Prime Minister Tan Sri Muhyddin Yassin that global banking firm Goldman Sachs has agreed to a US$3.9 billion (RM16.63 billion) settlement with the Malaysian government on defrauding of 1MDB, leaves an important question unanswered – “Is he letting Goldman Sachs off too lightly when we had earlier asked for USD 7.5 billion for their criminal involvement in 1MDB, where two of their senior executives have been charged by the US authorities and the Malaysian government has filed 17 criminal charges against Goldman Sachs?”

The previous Pakatan Harapan (PH) Malaysian government had claimed USD7.5 billion to recover USD6.5 billion in the following three 10-year bonds arranged by Goldman Sachs guaranteed by the Malaysian government at an interest rate above the prevailing market rates of:

1. USD1.75 billion at 5.99% interest rate issued on 18 May 2012

2. USD1.75 billion at 5.75% interest rate issued on 17 Oct 2012

3. USD3.0 billion at 4.4% interest rate issued on 16 Mar 2013

The previous PH government had claimed USD 7.5 billion from Goldman Sachs, to include the additional USD1 billion to cover interest cost incurred for the bonds to date.

The Prime Minister must come clean on whether out of the initial claim of USD 7.5 billion by the Malaysian Government, Goldman Sachs is only paying USD2.5 billion (RM10.66 billion) cash with the remainder USD 1.4 billion (RM6 billion), not paid by Goldman Sachs but recovered from stolen assets illicitly paid by 1MDB through the US Department of Justice. In other words, Goldman Sachs is only paying cash USD2.5 billion.

Apart from the USD 2.5 billion cash payment, if Goldman Sachs is willing to recover the remaining USD 4 billion in stolen assets, and not just USD1.4 billion, the Malaysian government can be justified for settling for USD 6.5 billion, and forgo the additional USD 1 billion of claims in interest servicing cost on our part.

To forgo the initial USD 7.5 billion claim with only USD 3.9 billion ignores the huge debt burden of 1MDB. The total 1MDB debt outstanding guaranteed by the Government is RM 31.7 billion ringgit. If the remaining interest payments till 2038 are included, the amount would increase to RM 41.5 billion. This sum excludes the RM8.9 billion which have already been paid by the Government. This would bring the total cost to the country, including interest of the 1MDB debts, to RM 50.4 billion.

For settling all our claims and criminal action against Goldman Sachs, Goldman Sachs is effectively paying only USD 2.5 billion cash. Even if not the full USD7.5 billion claim, the settlement should be at least USD 6.5 billion that Goldman Sachs was responsible for raising the 3 bonds. The Prime Minister should assure the public that he has not sold Malaysians short or allowed Goldman Sachs to get off too lightly for their involvement in one of the largest financial scandals in history – the RM50.4 billion 1MDB scandal.

Lim Guan Eng,

DAP Secretary-General,

Member of Parliament for Bagan.