Federal Government will not be able to pay civil servants their pension and retirement benefits as well as its debts within next 10 years unless Malaysians are united and determined to build up our nation and grow its economy.

It is with great sadness that the PN Government has presented a budget which has elements that will divide the nation based on race and religion.

I must applaud National Trust Party’s stand made through the media conference held by The Honourable Member of Parliament for Shah Alam, Mr Khalid Bin Abd Samad on 20/11/2020 (Friday) that the Malaysian 2021 budget should be fair to all irrespective of race and religion and that budget 2021 in its current form is divisive and unfair to non-Malays and non-Muslims. It is a universal fact that unfair treatment and injustice will cause resentment, division and strife. Any member of a family can testify how unfair treatment and injustice can tear a family apart let alone a nation.

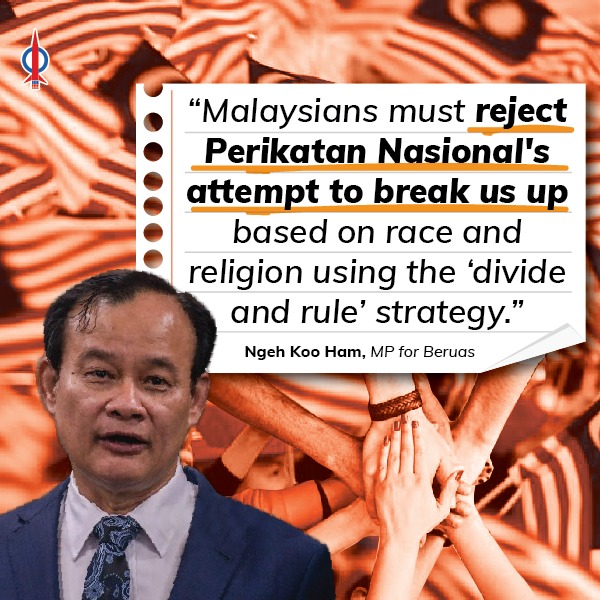

Malaysians cannot afford to be divided and must reject PN Government’s attempt to break us up based on race and religion in order to stay in power using the ‘divide and rule’ strategy.

Malaysians must realize that we have no choice but to sink or swim together with the following financial and economic challenges ahead of us.

The Federal Government will not be able to pay civil servants their pensions, retirement allowances and gratuities within the next 10 years.

At the start of the 9th Malaysia Plan in 2006, the amount needed to pay pensions, retirement allowances and gratuities was only RM5.86 billion. The amount needed in 2021 will be RM27.0 billion which is 4.6 times the figure 15 years ago. This amount will more than double by 2030. Currently, Malaysians who are 60 years and above is about 3.5 Million (10.7% of population) and will increase to about 5.0 Million (15% of population) by 2030.

The situation is aggravated by the decline in the younger working population. This is the consequence of the declining women fertility rate in Malaysia which is currently at about 1.8 children per woman. In 2020, we have 7.53 Million young workers compared to 7.8 Million in 2010. Can a smaller working population support an increasing population of pensioners in 10 years time?

- Federal Government Inability to pay debts

In 2006, the Federal Government’s debt was RM244.37 billion. At the end of March 2020, the Federal Government debt has jumped to RM823.8 billion (57.2% of GDP) and 6 months later by the end of September 2020 it has increased to RM874.3 billion (60.7% of GDP). If we were to include other liability exposure and commitments it has reached RM1.264 trillion.

As at September 2020, the Government has to borrow RM108.2 billion this year to pay maturing debts of RM56.8 billion with an additional nett loan of RM51.4 billion to cover the deficit for the said period. We must take note that the Government has to take loans to settle existing loans that have matured. The Government has not been able to generate enough revenue to settle existing loans.

The government has allocated RM39.0 billion to repay debt in 2021 which is clearly insufficient. The government is expected to borrow more money as in 2020 to cover maturing debts and the deficits in 2021. With accumulation of debts, the annual repayment of debts will continue to increase. Will the Government be able to repay its debts if it continues to accumulate in the next 10 years?

- Government’s inability to pay debts affect every Malaysian

Malaysians are our Government’s biggest creditors. If the Government cannot repay its debts, it means Malaysians will lose their money.

From the Parliamentary reply I received, the Federal Government’s creditors are as follows:-

- 75.8% owed to parties domiciled in Malaysia

- Employees Provident Fund (EPF) 26.9%

- Retirement Fund (Incorporated)(KWAP) 2.8%

- Insurance Companies 4.3%

- Banks 34.6%

- Development Financial Institutions 1.5%

75.8%

(b) Parties not domiciled in Malaysia 24.2%

100.0 %

A PN Government Deputy Minister has suggested to the Government to print more money. Should the Government print more money to settle the debts? If the government print more money unsupported by the supply of more goods and services, the value of the Malaysian Ringgit will drop. If the government print a lot of ringgit to pay Malaysians and its value dropped by 90%, effectively Malaysians have lost 90% of their money though they are paid in full. I have in my possession a Zimbabwean One Hundred Trillion Dollar note which was purchased with only RM30.00 to be kept as a souvenir. This is the result of the late Zimbabwean President Robert Mugabe’s monetary policy of printing more money to solve its economic problem.

In order for our nation to overcome the above problems, all Malaysians must unite to create wealth by creating more goods and services to grow our economy. Only with a bigger economy can we ensure that our Government has more income to pay pensions and retirement benefits and to repay its debts. We cannot afford to have a section of Malaysians due to racial and religious discrimination be discouraged from building up this beloved nation of ours. We cannot afford the flight of talents and capital from Malaysia to other nations which will adversely affect the economic wealth of our nation as we face the above said challenges.

We must all ensure that the Government stops awarding over priced contracts, rent seeking, cronyism and corruption.

Dato’ Ngeh Koo Ham

Member of Parliament for Beruas Constituency.