Media Statement by Member of Parliament for Bangi, Dr Ong Kian MIng on 9 November 2020:

“I know that you’ve had a tough 2020. But don’t worry, 2021 will be better. We think you business will improve by 6.5% to 7.5%. We’ll give you some help but less than what we gave in 2020. Once the vaccine comes, things will go back to normal. The worst is over. Here’s a small bandage for your wound.”

This is basically the gist of the recently announced 2021 budget. A slightly expansionary budget that is out of touch with the economic reality that was 2020 and the grim uncertainty of 2021. Still very much a peacetime budget when we are still very much at war with the ongoing effects of the COVID economy. The offering of a small bandage when most businesses are bleeding from multiple wounds.

Budget 2021 actually decreased COVID-related funds

But hold on… didn’t the government just announce the largest expenditure in Malaysian history for Budget 2021? Isn’t the government increasing the budget deficit significantly so that we can pump more money into the economy?

Yes, the projected budget deficit will increase from 3.4% to 6.0% of GDP in 2020 because of COVID related spending such as:

- Bantuan Prihatin Rakyat payments

- Wage Subsidy Program (WSP).

But rather than spending MORE in 2021 to face COVID related challenges, the budget deficit is projected to DECREASE to 5.4% in 2021.

At the same time, the allocation to the special COVID fund is projected to DECREASE from RM38 billion in 2020 to RM17 billion in 2021. Rather than having an over optimistic projection of economic growth in 2021, we should be preparing for the worst by planning to spend MORE in COVID related expenses in 2021 in order to save businesses and help vulnerable groups.

The development expenditure increase may not have the desired effect

But wait, wouldn’t the record setting RM69 billion in development expenditure be a helpful fiscal injection for the economy? It depends.

If the development expenditure can be rolled out relatively quickly, is transparent and has high multiplier effects, its economic effects will be enjoyed and felt by a larger proportion of the population.

For example:

- The RM500 million allocated in 2021 for the rollout of the National Fiberisation Connectivity Plan (NFCP) is very much needed especially for the semi-rural and rural areas.

- The additional development expenditure to repair dilapidated schools especially in Sabah and Sarawak is also much needed not just for the school children but also for the small contractors which are given these projects. This is assuming that the contracts are tendered out transparency and at reasonable costing.

But the bulk of the increase in development expenditure from the originally projected RM56 billion in the 2020 budget to the RM69 billion in the 2021 budget may not have the desired economic multiplier effects.

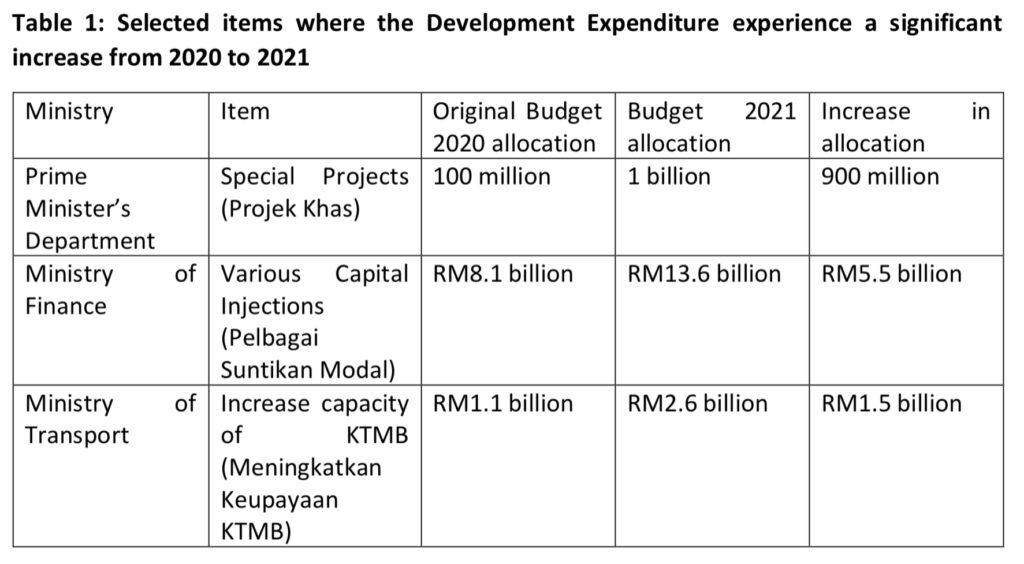

For example, the allocation for “special projects” under the Prime Minister’s Department has increased from RM100m in 2020 to RM1 billion in 2021. In the past, we have highlighted that such large allocations without stating the nature of such projects can be subject to great abuse and lacking in transparency.

At the same time, an additional RM5.5 billion has been allocated to the Ministry of Finance’s Development Expenditure (from RM8.1 billion in 2020 to RM13.6 billion in 2021) under the category of “various capital injections”.

Without knowing the details of these capital injections, it is hard to gauge how much of the real economy this additional expenditure will benefit. Finally, an additional RM1.5 billion worth of development expenditure was allocated to the Ministry of Transportation for increasing the capacity of KTMB. If this increase in allocation is largely for the much delayed Klang Valley Double Tracking (KVDT) project, then the multiplier effect is likely to be small because of the limited number of contractors involved.

Importance of having a bigger budget deficit in the COVID era

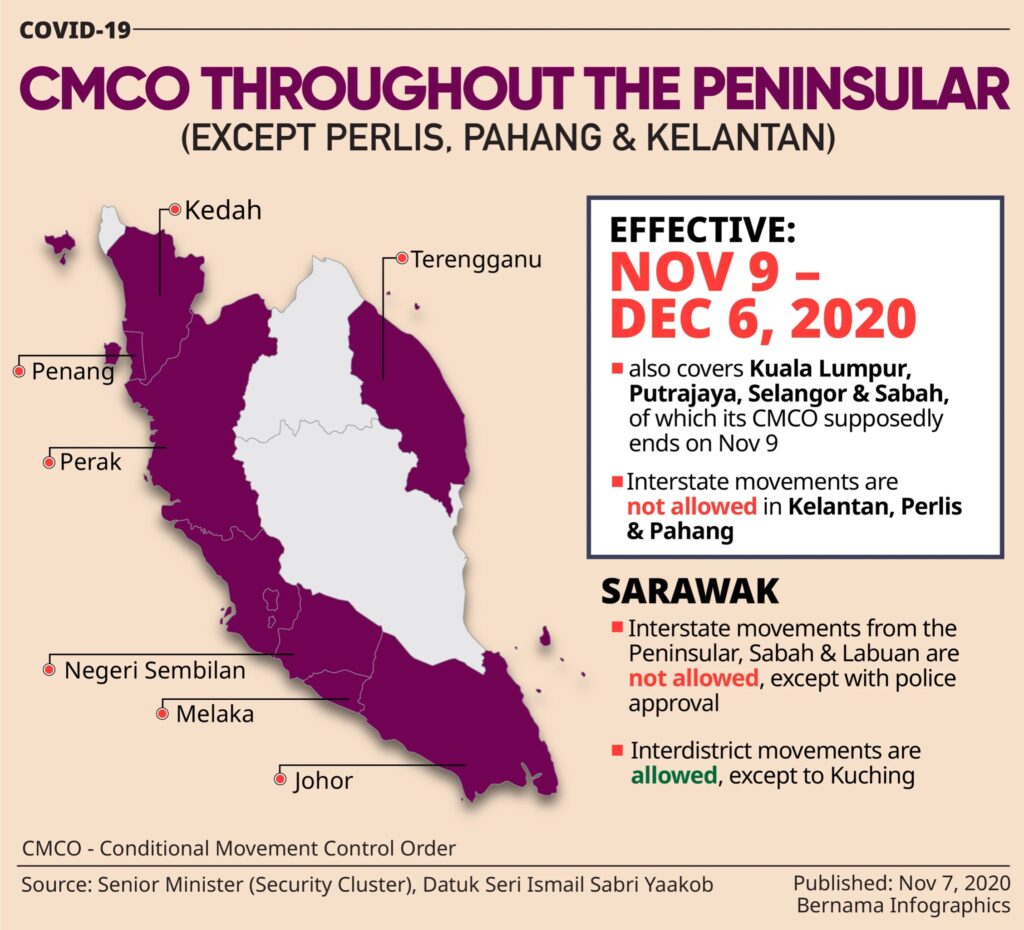

Why is it important for the government to plan to spend more and have a bigger budget deficit in 2021 compared to 2020? The recent reinstatement of the CMCO, which began in Sabah and Selangor in early October 2020, has now been expanded to all states in Peninsular Malaysia (with the exception of Perlis, Kelantan and Pahang) until the 6th of December.

The recent spike in COVID cases shows that this virus does not respect calenders or timelines.

There is no guarantee that the CMCO will not be extended into early 2021 or that it may make a sudden appearance again in 2021 even if the cases come under control by the end of 2020. We are seeing similar spikes occur in Europe and also in the United States. These new semi-lockdowns and lockdowns in Malaysia and other parts of the world will definitely have a negative economic impact and will likely slow economic recovery in 2021 as long as the COVID threat remains.

We also should not be too optimistic about the prospects of mass vaccination which may only be available in the 2nd half of 2021 at the earliest.

Many businesses have used up their cash reserves during the initial MCO period in the first half of 2020. The recent CMCO have hit them hard even though conditions under the CMCO are not as severe as under the MCO. The number of economically vulnerable have also increased as evidenced by the increase in self unemployment over the past few months even as the number of unemployed have dropped slightly. What this means is that more SMEs and vulnerable families are expected to require assistance in 2021 compared to 2020.

A ‘wait and see’ approach is a BAD idea

Wait a minute… What if the government is adopting a wait and see attitude before deciding to spend more in 2021? Perhaps the government is willing to spend more but only if the signs of economic recovery are weak in 2021?

This kind of ‘business as usual’ thinking is one of the main shortcomings of this budget.

If we wait until things become worse before deciding to spend more, it will be ‘too little too late’.

We can look to Sabah as an example. I am sure that the economic situation in Sabah is much more serious compared to the Klang Valley given the number of COVID cases and also the number of people working in the service sector and in the informal economy.

However, under Budget 2021, the only additional assistance given to Sabah is the Special Prihatin Grant (Grant Khas Prihatin) of RM1000 to 20,000 traders and hawkers and taxi, ehailing drivers, rental car and tour drivers in Sabah.

This kind of one-off assistance is simply insufficient especially since the number of COVID cases in Sabah shows no sign of being under control anytime soon. If the same kind of ‘business as usual’ attitude is adopted for 2021, without more government assistance and direction, we can expect more suffering among businesses and vulnerable families.

COVID economy requires a ‘war time’ approach

What we need in Budget 2021 is a ‘war time’ approach in facing the challenges of the COVID economy. This means that we have to budget for a significant increase in government spending and be ready to accept a budget deficit that is higher than the currently projected 5.4% of GDP. The allocation to the COVID fund needs to be increased significantly from the currently budgeted RM17b for 2021.

The increase in this fund can be used for the following purposes:

(i) Increase the Wage Subsidy Program (WSP) to at least RM1000 per Malaysian worker (from the current RM600 per worker) for all businesses which are in the CMCO areas which cannot operate as per normal (especially in the retail, service and tourism sectors)

(ii) Provide an allocation to heavily subsidized testing on a regular basis for workers (once a month to start) as a pre-emptive measure to control the COVID virus.

(iii) Provide a 6 month EIS contribution for free with a 50% matching contribution for another 6 months to ALL workers who have not signed up for the EIS in order to capture workers in the informal sectors and to provide the necessary assistance to them if they cannot work as a result of a CMCO.

(iv) Provide cash grants of RM1000 per month per Malaysian family in areas under EMCO. This incentive will also limit the number of people who will ‘escape’ from the EMCO areas before the lockdown begins.

Without such bold thinking on measures to help businesses and vulnerable families, the current Budget 2021 is underwhelming and makes us unprepared to face the challenges of a COVID economy in 2021.

Dr Ong Kian Ming

MP for Bangi

DAP Assistant Political Education Director