Press Statement by DAP Secretary-General and MP For Bagan, Lim Guan Eng in Kuala Lumpur on 16 November 2020.

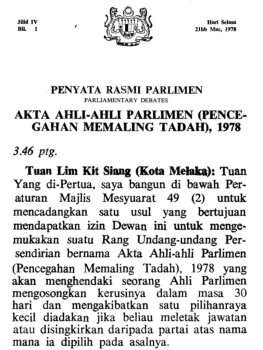

An Additional RM45 Billion For Budget 2021 or Extra 4% Deficit To GDP To Counter The Slow Economic Recovery Next Year Which Is Not Expected To Hit The Projected 7.5% GDP Growth Next Year

An additional RM45 Billion for Budget 2021 or extra 4% deficit to GDP to counter the slow economic recovery next year, which is not expected to hit the projected 7.5% GDP growth next year. This follows pessimism that Malaysia’s GDP can grow by 7.5% in 2021, after a projected 4.5% contraction in 2020 due to the Covid-19 pandemic.

The government has said that the strong rebound in GDP growth of 7.5% in 2021 will be driven by the anticipated improvement in global growth and international trade as well as the impact of the RM305 billion Kita Prihatin stimulus package. This is unrealistic when the sources of GDP growth next year has all but disappeared.

Global growth is expected to be weak next year following the new wave of COVID-19 infections and the winding down of the government’s stimulus package next year with the COVID-19 fund being reduced drastically from RM38 billion in 2020 to RM17 billion in 2021. Further, the sharp decline in Malaysia’s gross fixed capital formation by 11.6% in the third quarter this year, affects the economy’s potential growth and damages Malaysia’s competitiveness since other countries in Asia are not experiencing the same phenomenon.

The sharp decline in gross fixed capital formation 11.6% is a setback for economic confidence of future growth. To counter that, DAP proposes an additional RM45 billion fiscal measure equivalent to an extra 4% deficit, encompassing social protection, job creation, saving businesses and investing in the future with new technology and education:

1. Implement immediate increase in monthly welfare aid to RM1,000.

First, there should be immediate implementation of the increase in monthly welfare aid from RM200-300 to RM1,000 including unemployed that is expected to hit 1 million, that will cost RM12 billion. This will provide an immediate safety net for unemployed workers.

2. Moratorium extension for another 6 months.

Two, an extension of the moratorium of bank loan repayments by another 6 months when it expires on 30 September, costing RM6.4 billion that will help 8 million Malaysian individuals and companies. In contrast the targeted bank loan moratorium extension and bank assistance after 30 September, have assisted only 645,000 borrowers, which is only 8% of the original 8 million borrowers. Many have complained that this does not benefit them but only financial institutions by merely extending the loan repayment period, thereby requiring even higher interest payments.

3. Work hiring incentives over a period of 2 years under Malaysia@Work

Three, work hiring incentives over a period of 2 years, under Malaysia@Work of RM500 a month to employees and RM300 per month to employers to encourage them to hire local workers as proposed by PH in the 2020 Budget. Expanding this scheme to cover 600,000 Malaysian workers and their employers would cost RM13 billion. This would also help the more than 500,000 youths who are unemployed.

4. Digitalising Education

Fourthly the remaining RM4 billion should be spent on digitalising education including buying laptops to provide on-line learning for students not able to attend schools.

5. RM10 billion lifeline for new and existing businesses, especially the tourism industry

Fifthly RM10 billion should be given to provide a lifeline for new and existing businesses, loans and credit extensions, especially for the crippled tourism industry. Malaysia Budget Hotel Association (Mybha) expects 40 budget hotels will be forced to close down with about 2,000 workers losing their jobs, if the government did not step in. The RM1 billion Penjana Tourism Financing facility was very difficult to obtain, with only 3% of the applications submitted by its 2,300 members had been approved due to the strict rules imposed by the banks.

To save and pull the economy out of our current economic recession, the government’s financial focus should shift from controlling our debt levels and fiscal deficit, to borrowing more money. The obsession with controlling our deficit to protect our sovereign credit ratings must give way to borrowing more money to save Malaysian jobs, businesses and livelihood.

Lim Guan Eng,

DAP Secretary-General,

MP for Bagan.