The implementation of GST and the removal of sugar subsidy will impact the lives of many Malaysians, particularly the lower income group, said DAP Vice chairperson Teresa Kok.”Pakatan Rakyat has many times stated that the GST should not be implemented as it will affect the lower income group of Malaysians who are already burdened by increased prices of many goods. Yet the government in its eagerness to collect more revenue has chosen to announce GST implementation in 2015 without taking concrete steps to improve governance, curb wastage, leakage and corruption,” she said.

The implementation of GST and the removal of sugar subsidy will impact the lives of many Malaysians, particularly the lower income group, said DAP Vice chairperson Teresa Kok.”Pakatan Rakyat has many times stated that the GST should not be implemented as it will affect the lower income group of Malaysians who are already burdened by increased prices of many goods. Yet the government in its eagerness to collect more revenue has chosen to announce GST implementation in 2015 without taking concrete steps to improve governance, curb wastage, leakage and corruption,” she said.

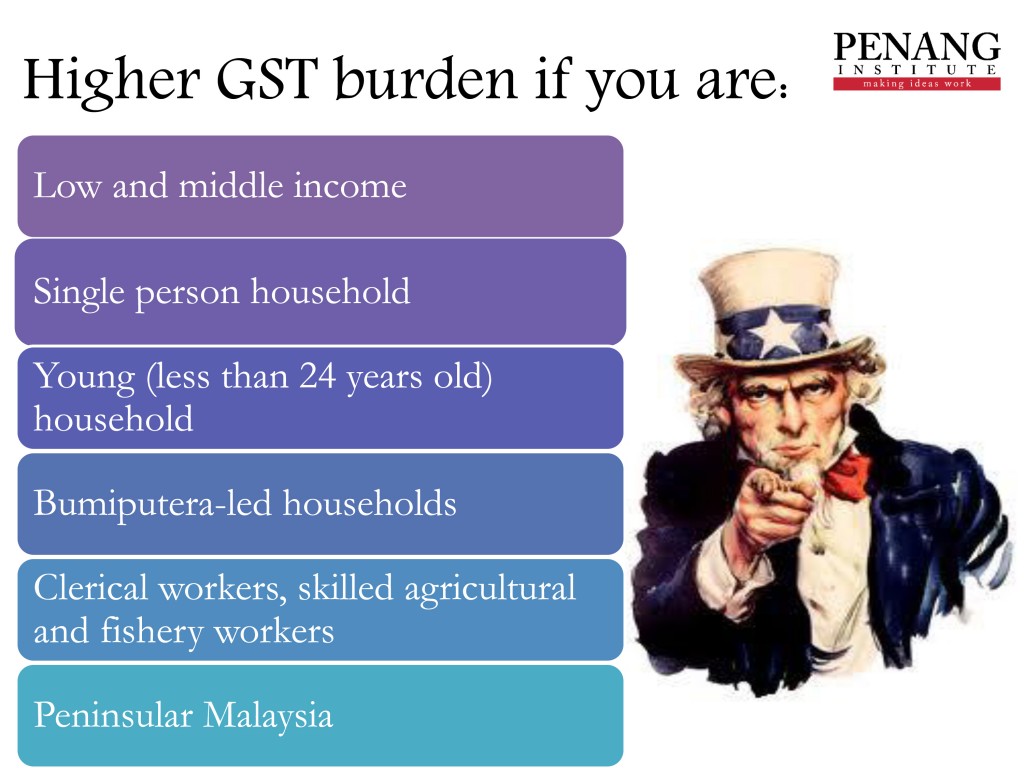

The Seputeh MP refuted the government’s explanation that the GST would not bring “too big of an impact” as the government has taken the effects of the consumption tax into consideration. She pointed out that a recent research paper by Penang Institute showed that GST could cause prices to balloon by 3.38%, despite essential items being exempted.

Poorer households will bear the GST burden

The paper titled “GST is a regressive tax” written by Penang Institute fellow Dr. Lim Kim Hwa and Research Analyst Ooi Pei Qi also found that GST will have a regressive effect with lower income households bearing a higher tax burden than higher income households. The research paper is made available to the public here: http://www.penanginstitute.org/gst/

The paper titled “GST is a regressive tax” written by Penang Institute fellow Dr. Lim Kim Hwa and Research Analyst Ooi Pei Qi also found that GST will have a regressive effect with lower income households bearing a higher tax burden than higher income households. The research paper is made available to the public here: http://www.penanginstitute.org/gst/

The analysis has shown that using 6% as the standard GST rate, the average household is expected to pay 2.52% of monthly income as GST (equivalent to RM 90 per month in July 2013 values). Of particular interest, it showed that low and middle income households, single persons, those below 24 years of age, Bumiputera households and those in Peninsular Malaysia would be most affected by the tax.

Kok said that this showed that the BN government was not living up to its “People First “slogan.

Multiplier effect expected from sugar subsidy removal

Meanwhile, the recently announced removal of the 34 sen per kilogramme sugar subsidy was expected to cause a multiplier effect on prices of foods and drinks, Kok said.

Prime Minister Datuk Seri Najib Razak rationalised the subsidy abolishment by saying that 2.6 million Malaysians under the age of 30 were diabetic patients. Rubbishing the claim as a “lame excuse”, Kok said that the government should instead carry out public education on the need to reduce sugar intake.

“If price increase can be effective in getting people to consume less sugar, then all the taxes imposed on alcohol and tobacco should have been effective in reducing the number of smokers and alcohol drinkers in the country. But is this true?” she asked.