Remember almost punching a hole through your phone trying to click on your location on the My Sejahtera application?

Well now, we have a large group of people who have been banging their heads against the wall because they can’t access government aid, however much they try.

This is because they don’t quite fit the SME (small and medium enterprises) mould but are community-based businesses, who are struggling to survive.

This afternoon, my office and business association leaders had a follow-up meeting chaired by Deputy Finance Minister YB Sahar Abdullah along with seven heads of the Ministry of Finance agencies and Bank Negara Malaysia on the Rental Relief Fund.

We underlined a few key points from the business sustainability survey by my office that consists of 1,196 respondents from different community centered small business.

Only about 27.8% of them have received the rental discount/waiver from their landlords.

The given amount and duration are also insignificant compared to the toxic combination of high operating costs (rental and labor) and falling sales plus lower revenues.

51.3% respondents who didn’t receive any rental assistance at all, argued that the scheme only works at the mercy of the landlords, who themselves also experienced losses and have other financial commitments.

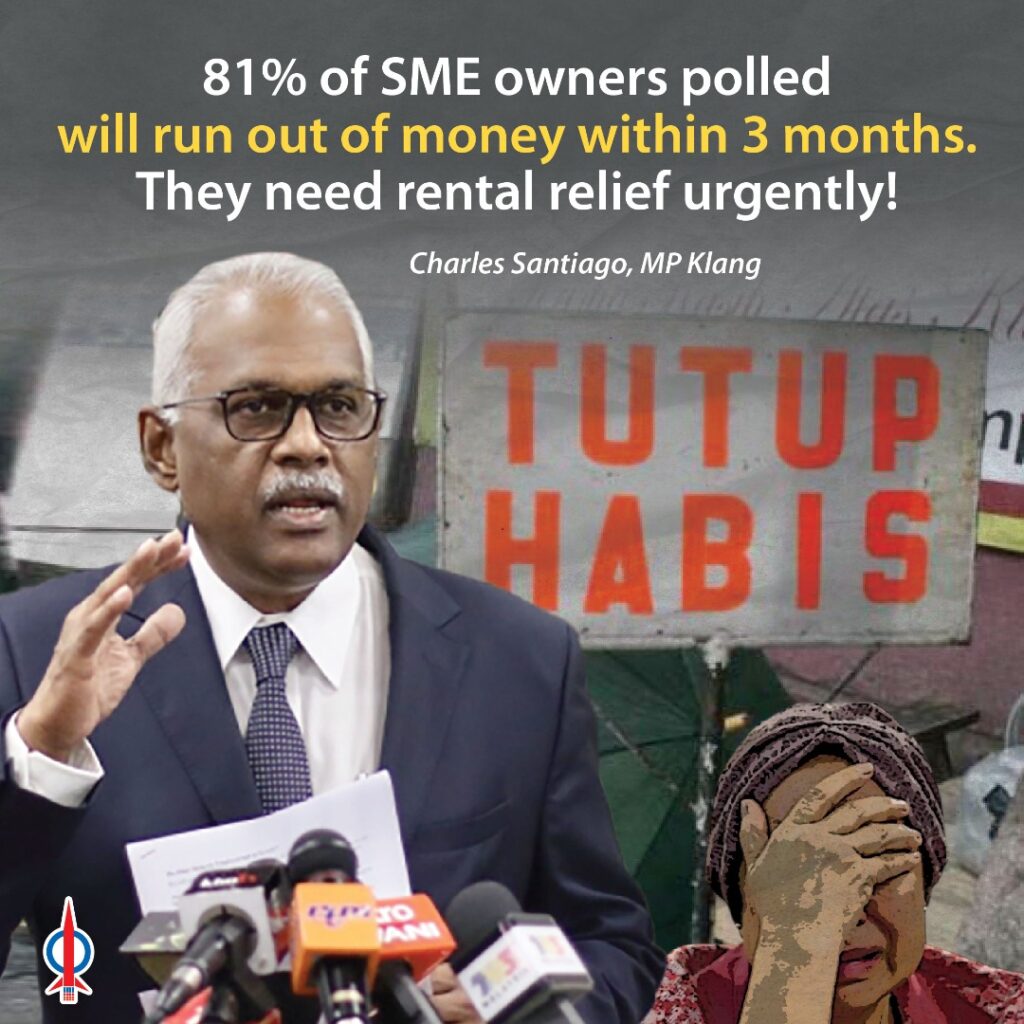

A staggering 81% said they will exhaust their savings between one and three months, forcing them to consider closing their business permanently.

Worse still, 60.2% of the respondents have tried but failed to obtain any loan from financial institutions.

This statistics is logical because small businesses have poor evidence of strong cash flow and bad credit score because they are still suffering from revenue drop and yet to recover from the ripple effects of continued Movement Control Order (MCO) and drop in demand.

All of these examples indicate that despite the government’s proposed economic stimulus packages totalling RM 340 billion, the most vulnerable business communities still fall through the cracks.

We must acknowledge the critical link between small businesses and the local communities.

So, think of the barber you have visited from the time you were a toddler.

Or the old uncle and his wife, who have had the pharmacy down the road from your home for ages.

If these small businesses shutter, communities will also be drastically affected as residents depend on them for basic needs and services.

And the next thing you know, a multinational corporation would have taken over these businesses, done a facelift and increased prices.

With an allocation of RM 1.7 billion for rental relief, we can save more than 59,000 businesses and 590,000 jobs.

Therefore, it’s imminent that a special committee on Rental Relief Fund is set-up between the Ministry and small business without delay, to synergise the existing schemes and work out a dynamic rollout mechanism.

Charles Santiago

Member of Parliament Klang

The Rental Relief Fund framework is proposed as below:

(i) SUBSIDY AMOUNT: 70% of the existing rent, capped at RM7,000

(ii) SUBSIDY PERIOD: 2 months. Review and renew for another 2 months. (from July to October 2021)

(iii) REQUIREMENT: Community based businesses or Informal sector; Annual revenue drop more than 40%

(iv) REQUIRED DOCUMENTS: Business license & Income tax declaration on rental and annual revenue drop

(v) APPLICATION METHOD: Apply through local government

(vi) PAYMENT METHOD: Direct payment to the landlords

(vii) TARGETED GROUPS: Hawkers, restaurants, coffeeshops, barbershops, pharmacies, community retail shops etc.