The Ministry of Finance has done well to complete the RM2.83 billion settlement with Ambank Bhd over their culpability in the 1MDB corruption scandal and must now ensure similar resolutions with for 1MDB auditors, KPMG and Deloitte, whether through the Courts or settlements.

I am happy to see the efforts to reclaim the loss of funds by the Government as a result of the 1MDB scandal started under the Pakatan Harapan administration are now bearing fruits.

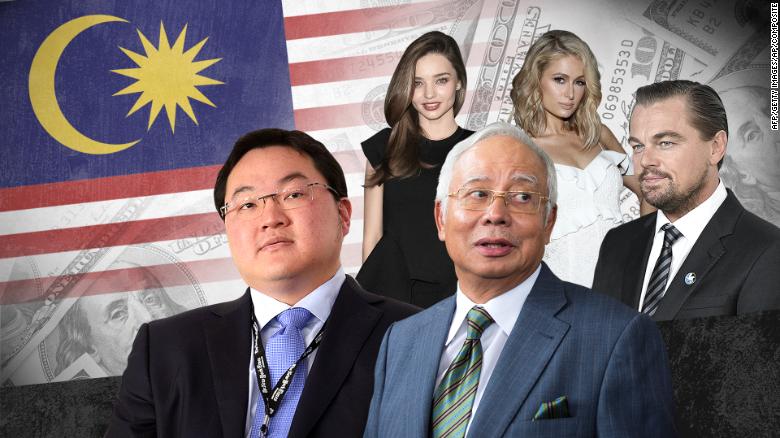

The Ministry of Finance have previously engaged lawyers and accountants to prepare comprehensive claims against all parties who have been directly or indirectly culpable for the tens of billions of ringgit lost and misappropriated by former Prime Minister, Dato’ Seri Najib Razak and his associates via 1MDB.

These claim documents were completed in the final weeks before the betrayal against the people’s mandate for Pakatan Harapan by unprincipled Members of Parliament to form a new Government.

I must also express my appreciation to the senior management of Ambank Bhd for their steadfast cooperation on this matter during our time in administration.

The new management of Ambank had made no attempts to deny their culpability and were eager to make amends to move forward. I believe that the settlement of RM2.83 billion, which amounted to nearly 30% of the bank’s market capitalisation is a fair sum, given the level of cooperation provided to the Government.

I call upon the Finance Ministry to now set their focus on the claims against the former 1MDB auditors, KPMG and Deloitte Malaysia. Like the Ambank case, the claim documents against both entities were completed by the professionals more than a year ago.

However, unlike the degree of forthcoming cooperation shown by Ambank, these ‘international’ auditors have failed to demonstrate any remorse and have refused to acknowledge any degree of culpability in the RM50 billion scandal despite clear evidence of their failure to carry out their audit responsibilities in a competent and diligent manner.

In fact, I have personally filed complaints against both KPMG and Deloitte as well as their respective partners Ahmad Nasri Abdul Wahab and Ng Yee Hong, in March and June 2015 respectively with the Malaysian Institute of Accountants (MIA) for the filing of fraudulent 1MDB annual financial statements.

My complaint against KPMG was for its failure to take into consideration the material disclosures of the transactions which took place in 1MDB’s then US$1 billion investment to form an aborted joint venture with Petrosaudi International Limited in 2009-2010, including at least US$700 million that was siphoned to Jho Low’s company, Good Star Limited.

KPMG had performed the arguably record-breaking feat of signing off the March 2010 financial audit within 3 weeks after being appointed in September 2010, after the original auditors Ernst & Young (EY) were sacked. EY’s had refused to sign off 1MDB’s financial statement due to irregularities in the transactions with Petrosaudi.

Deloitte, on the other hand, took over from KPMG after the latter was sacked by 1MDB in December 2013. KPMG had refused to sign off the March 2013 accounts because it was unable to verify the authenticity of 1MDB’s US$2.318 billion investment in a dodgy investment fund parked in Cayman Islands.

I had accused Deloitte Malaysia of intentionally and/or negligently failing to conduct sufficient and necessary due diligence and audit of the cash flow and liquidity risk 1MDB.

Deloitte endorsed 1MDB as a going concern on 5 November 2014, after which 1MDB immediately failed to repay a RM2 billion loan at the end of November 2014. This was because Deloitte Malaysia has failed to perform a thorough authentication and verification of 1MDB’s investment in the Cayman Islands, which turned out to be fraudulent.

In addition, Deloitte Malaysia has failed in its audit of 1MDB’s financial statements for March 2013 and 2014 when it failed to properly expense the stock options which 1MDB had granted to Abu Dhabi’s Aabar Investment PJS.

The failure to account for the stock options granted, meant that 1MDB reported hundreds of millions of ringgit of inflated profits for these two years.

However, both KPMG and Deloitte have litigiously contested, blocked and were uncooperative with the entire investigation and hearing process with the sole intention of getting off the hook with regards to their role in the 1MDB scandal.

Both firms have listed “Integrity” as the number one ‘value’ in their organisation, but their actions have proved that they have little or no integrity when their bottom lines are threatened.

I call upon the MoF not to give any quarters in their negotiations with Deloitte and KPMG.

If they have demonstrated no remorse for their culpability in the tens of billions of ringgit for the Malaysian tax-payers, MoF, via 1MDB must immediately file the relevant suits, which have been fully prepared, against them in the Courts.

Tony Pua,

MP for Damansara