Media statement by DAP Assistant National Publicity Secretary and DAP Penang Vice-Chairman, Zairil Khir Johari on 11 May 2021:

Federal Government should grant an immediate three-month loan moratorium and cash aid to help Malaysians overcome MCO 3.0

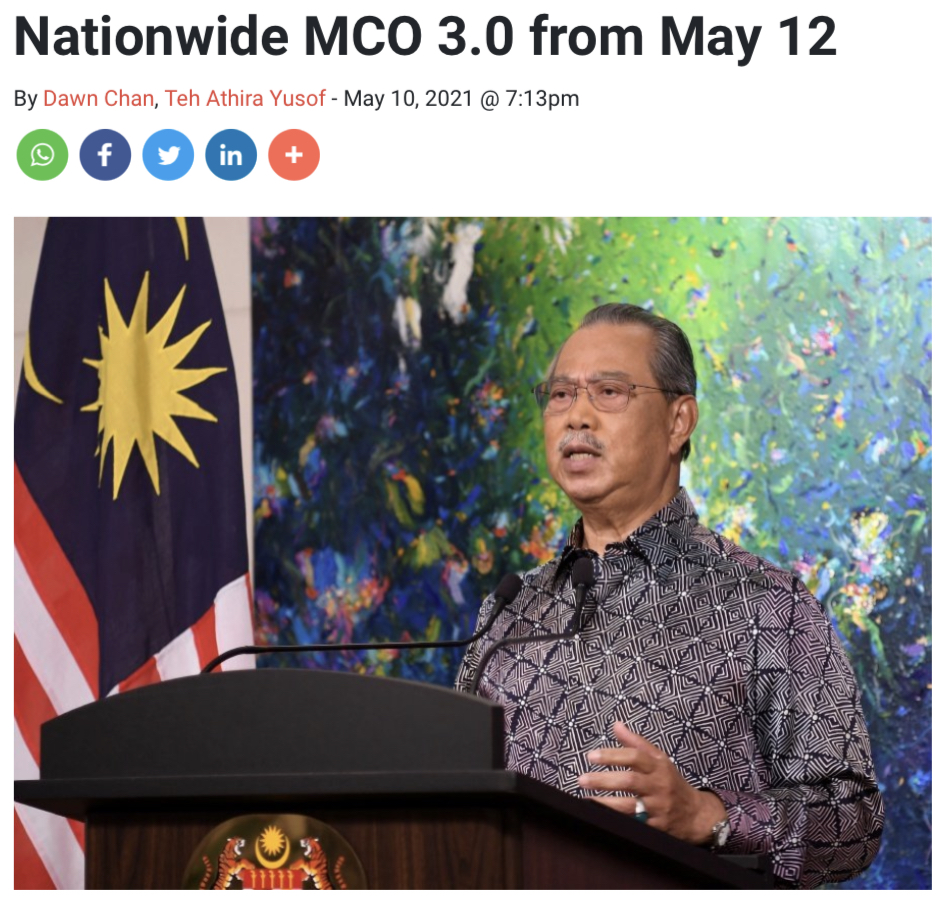

The sudden announcement of a nationwide Movement Control Order (MCO 3.0) on the eve of one of our most festive celebrations speaks volumes about the failure of the Perikatan Nasional government to contain and control the spread of the Covid-19 pandemic.

That it is necessary given the current circumstances is not doubted, yet many questions can be asked about how we have arrived at this point when a number of countries around the world are already beginning to ease lockdown restrictions following successful national vaccination campaigns.

Instead of celebrating in the lead up to Hari Raya Aidilfitri, we find ourselves at a harrowing juncture. Infection rates show no sign of letting up while cumulative cases are threatening to hit the half a million mark in a matter of weeks if things don’t improve. Meanwhile, only around 3.4% of our population have received at least a single dose of the vaccine, making us laggards compared to countries with far larger populations that have achieved about 50% vaccination rates.

More critically, Malaysians in every demographic of society are now struggling to get by, burdened even further by constant inconsistencies and flip-flopping which serve only to confuse a public already fuming with the disproportionate and inequitable enforcement of SOPs.

Immediate three-month loan moratorium

With the imposition of MCO 3.0, I urge the Federal Government to immediately issue a three-month loan moratorium and other supportive packages to reduce the economic burdens that are sure to threaten our society.

With SMEs employing almost half of Malaysia’s labour force, a loan moratorium would have an immediate impact to this important sector of the economy. Business owners can improve their cashflow while employees will be encouraged by increased job security.

With the youth unemployment rate recording a high of 13.9% earlier this year and unemployment generally hovering around the 4.8% mark, a loan moratorium would undoubtedly help save many jobs.

More importantly, a loan moratorium such as the one implemented last year would provide instant relief to millions of borrowers besides lubricating the economy with some badly needed liquidity.

Three-month cash assistance for the B40 and M40

Despite a total of six stimulus packages announced to date totalling RM340 billion (PRIHATIN RM250 billion, PRIHATIN SMEs RM10 billion, PENJANA RM35 billion, Kita PRIHATIN RM10 billion, PERMAI RM15 billion and the latest PEMERKASA RM20 billion), coupled with the raiding of the National Trust Fund (KWAN), it is evident that all these lofty numbers are not felt by the man on the street.

On top of that, it has also been apparent that the pandemic has most affected the lower earners in society disproportionately more. Not only are they victims of double standards in the enforcement of SOPs, most of the so-called economic aid packages are also inaccessible to them.

If the Federal Government truly cares about the welfare of the rakyat, then they should consider providing targeted monthly cash assistance of RM1,000 for the B40 and RM500 for the M40 for three months. On top of the loan moratorium, such a measure will definitely go a long way in assisting those worst hit, especially with the need for online learning as schools are shut once again.

Despite the State of Emergency imposed since January this year, the Perikatan Nasional Federal Government has clearly failed to curb the pandemic. Worse, the latest imposition of a month-long nationwide lockdown, with the possibility of further extensions if things don’t improve, threatens to unravel the socio-economic fabric of our society if urgent economic measures are not taken to address them.