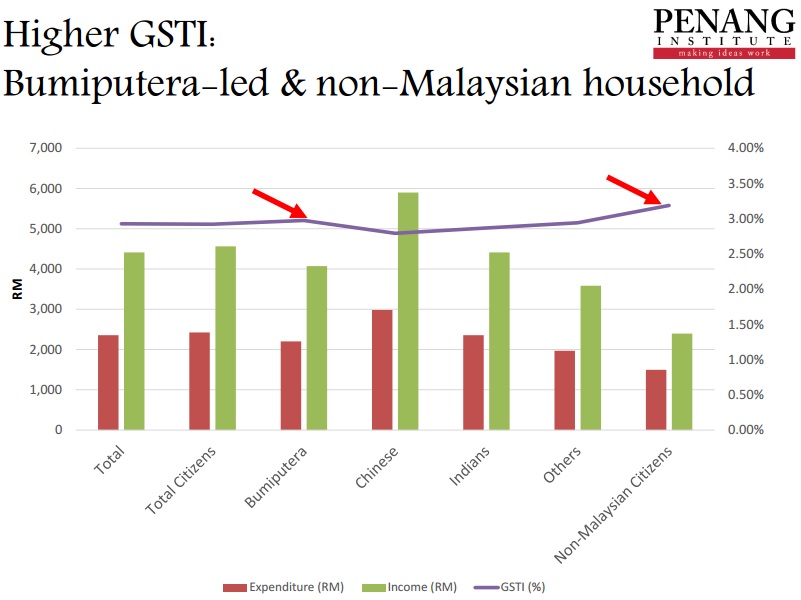

Think tank Penang Institute published a detailed study on Goods and Services Tax (GST) that classifies it as a regressive tax that would affect Bumiputera households and non Malaysian households the most.

Think tank Penang Institute published a detailed study on Goods and Services Tax (GST) that classifies it as a regressive tax that would affect Bumiputera households and non Malaysian households the most.

The American Internal Revenue Service (IRS) defines regressive tax as a tax that takes a larger percentage of income from low-income groups than from high-income groups, as opposed to progressive tax which is vice versa.

The study highlighted, among the other effects of GST, that Bumiputera and non-Malaysian households would be forking out GST per household income at a higher percentage compared to other races.

The study done, was based on Bank Negara’s estimates of income or expenditure combined with the latest Household and Expenditure Survey for 2009 and 2010. The evaluation of the burden of GST took into account the level of income, and households’ spending pattern.

Apart from hitting the low to middle income households, The Penang Institute also found that that the households which would pay higher percentages of their income as GST would include those engaged as technicians, clerical and services workers, farmers, fishermen, single person households, young households (less than 24 years old) and households in Peninsular Malaysia

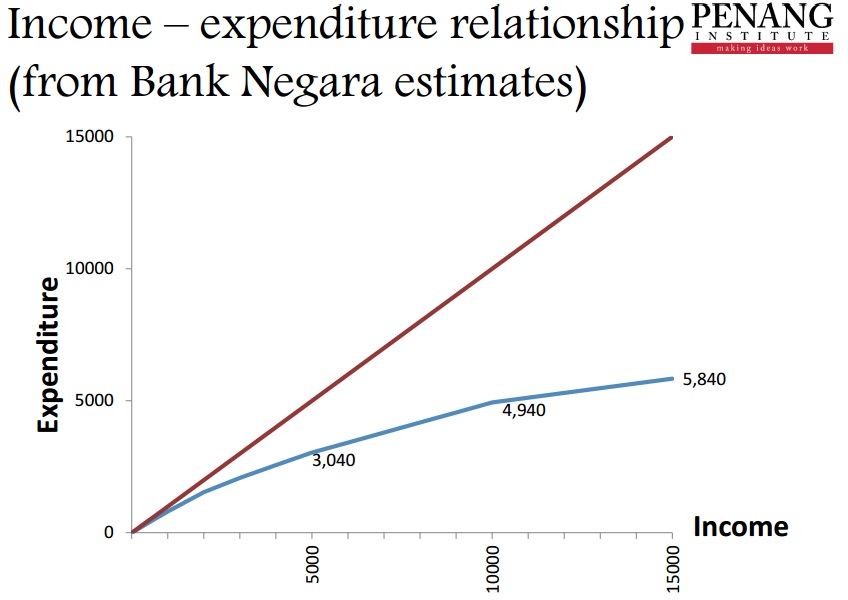

As shown in the Income-expenditure relationship (left), even when household incomes increase, the increase in expenditure would be steeper.

As shown in the Income-expenditure relationship (left), even when household incomes increase, the increase in expenditure would be steeper.

The Penang Institute study by Lim Kim-Hwa and Ooi Pei Qi concluded that GST is intrinsically regressive, saying,

“The implementation of an ill-thought out welfare system is likely to lead to inflation, abuse, wastage and possibly accentuate a dependency culture.

Although cash hand outs can be a quick fix and might be a politically savvy move, this might not be conducive in spurring economic growth led by innovation, knowledge and entrepreneurship.” -The Rocket