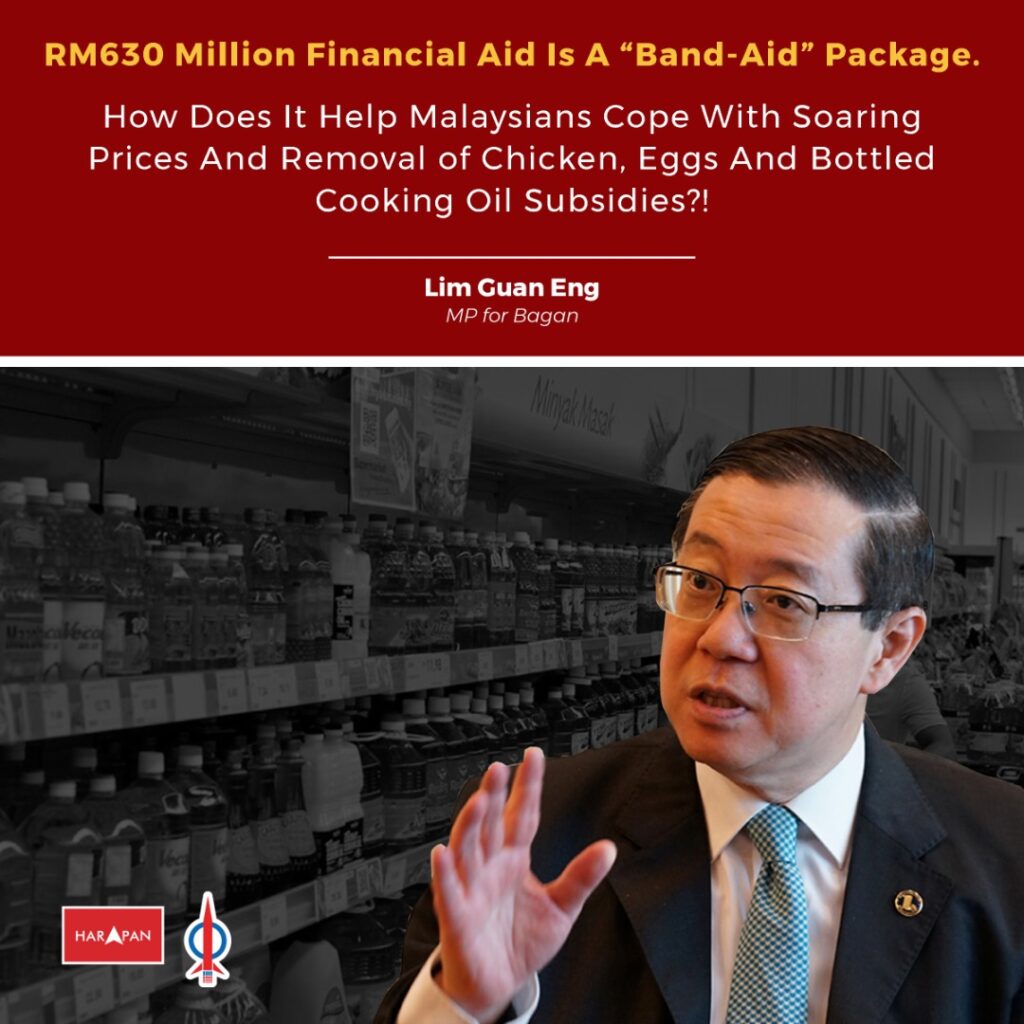

How does Prime Minister’s Ismail Sabri’s paltry RM630 million “band aid” package help Malaysians cope with soaring prices and removal of chicken, eggs and bottled cooking oil subsidies? As a comparison, Singapore with a GDP per capita almost 5 times more than Malaysia had announced a Sing$1.5 billion or RM4.7 billion aid package that is more than 7 times larger than Malaysia’s RM630 million aid package.

This RM630 million financial aid is disappointing not only in its small amount but also not comprehensive to help Malaysians in the M40 as well as small and medium scale enterprises. As a start, Ismail should have announced that Tenaga Nasional Bhd should not be permitted to increase electricity tariffs from next month onwards.

Tenaga Nasional Bhd’s (TNB) net profit rose to RM3.66 billion for the financial year ended Dec 31, 2021 from RM3.59 billion in the previous year on the back of a 2021 higher operating profit increasing by RM742 million of RM8.08 billion compared with RM7.36 billion in 2020. Clearly TNB is in a position to absorb rising gas and coal prices.

Finally there has been no announcement of when the acute workers shortage caused by Ministerial and bureaucratic obstacles on bringing in foreign workers will be resolved. The acute workers shortage has adversely impacted all sectors from plantation to manufacturing to tourism and services industry. Not only have businesses been forced to close down, but many are refusing to accept new orders or operating at far below capacity such as hotels impacting on economic growth.

There is no mention of a Price Stabilisation Fund or buffer stockpile of essential commodities to cope with prices that are expected to escalate even higher at the end of the year. The lack of a well-thought out plan does not bode well for investor confidence already battered by the 2022 International Institute for Management Development (IMD) World Competitiveness Ranking (WCR), down by seven positions from 25th in 2021. This is reflected in the downward spiralling of share prices and decline in the value of the ringgit against our major trading partners, United States and Singapore to near historic levels, putting further pressure on imported inflation.

Lim Guan Eng

MP for Bagan