1 Malaysia Development Berhad (1MDB) owned Ivory Merge Sdn Bhd will be acquiring Tadmax Resources Bhd’s (Tadmax) 310 acre Pulau Indah land for RM 317,334,600 as announced by Tadmax on Friday, 20 February 2014.

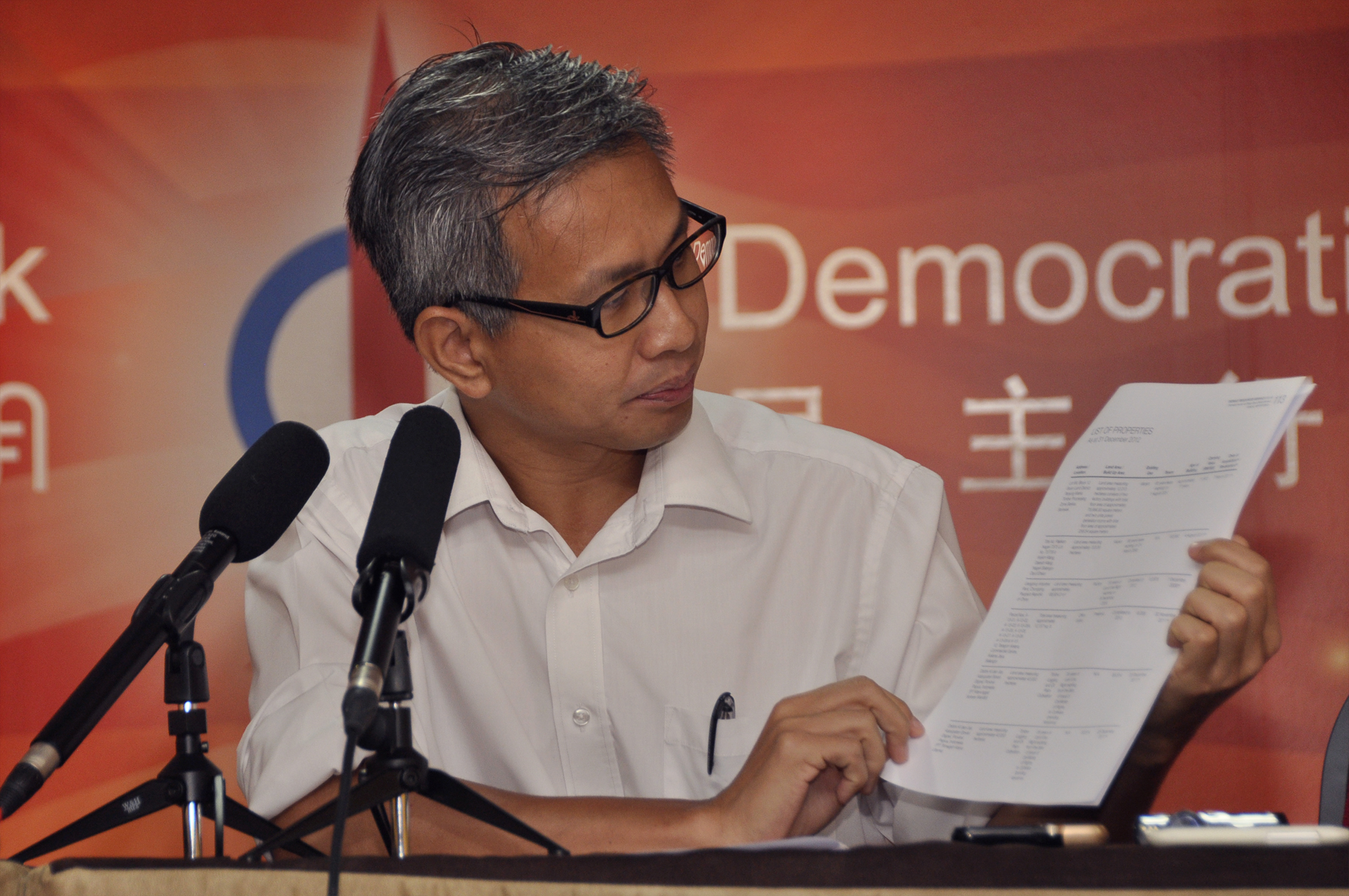

The sale agreement prompted Petaling Jaya MP Tony Pua to question the sudden need to “invest” in a land previously valued at only RM 9.93 per square feet(psf) at the current price of RM 23.50 psf.

“How did the value of the vacant land increase by 137% in less than 2.5 years?” he asked.

Tadmax , whose directors include Chairman Abdul Azim Zabidi (former treasurer for UMNO) and Chief Executive Officer (CEO) Faizal Abdullah (Deputy Chairman of UMNO Kapar Division) valued the 379 acre Pulau Indah land at a mere RM 163.9 million in the company’s 2012 Annual Report. Faizal Abdullah had expressed in an earlier statement that the sale would alleviate their RM 220 million debt burden and be hauled out of the red with a surplus of RM 50 million.

Two months ago, it was announced on Bursa Malaysia that Faizal Abdullah had bought additional 6,735,000 shares of Tadmax between 9 to 12 December 2013 at an average of 34.5 sen per share and increased his stake by 4.78%. Tadmax stocks closed at 60.5 sen as of 21 February 2014.

Tony also highlighted that Tadmax, formerly known as Wijaya Baru Global Bhd (WBGD), was infamous for its complicity in the RM 12.5 billion Port Klang Free Zone (PKFZ) scandal where Kuala Dimensi Sdn Bhd (KDSB) , a subsidiary of Tadmax (formerly WGBD), sold the 753 acre land for an astronomical price of RM 1.09 billion Port Klang Authority (PKA). Tadmax’s largest shareholder then, Tiong King Sing, who was also the CEO of KDSB, currently holds a 5.53% stake in Tadmax.

He added that 1MDB, currently in heavy debt with an estimated amount of more than RM 30billion, is also pursuing two mega property development projects in Tun Razak Exchange and Bandar Malaysia, for which raises additional debt.

“Given the history of Tadmax, its legal entanglements with the Government authorities and the state of its financial affairs, as well as as the sudden increase in the valuation of the transacted land, 1MDB must immediately assure Malaysian tax-payers that this is not a bailout for Tadmax and its shareholders”.

“I’m absolutely worried that the financial controversies in 1MDB of which this (the Tadmax deal) is assumed to be playing a part, would become the single biggest financial scandal in Malaysian history,” he said.